Market segmentation and the bowling pin strategy

How Crossing the Chasm guides startups in 2025

“When you’re surfing a technology wave, gravity is your only true competitor. Win the first break, and the rest of the ride feels effortless; miss it, and you’re paddling against the current for years, watching others carve past.”

— Geoffrey Moore in Crossing the Chasm

Why We Still Talk About Geoffrey Moore (Especially Now)

Every few years, a new technology wave hits – a fundamental shift that makes people rethink everything. We saw it with the web in the '90s, felt it crackle with mobile in the late 2000s, built empires on it with the cloud in the 2010s, and right now, we're paddling hard into the massive swell of Generative AI.

These aren't just tech trends; they're moments of mass behavioral plasticity. Habits get questioned, workflows get disrupted, and incumbents look nervously over their shoulders. This fleeting openness to change is the oxygen startups breathe. But it’s also incredibly dangerous.

Geoffrey Moore's Crossing the Chasm remains the essential field manual because it brutally diagnoses why most startups, filled with brilliant people and backed by smart money, wipe out precisely when the wave looks biggest and most promising. It’s not about the tech; it’s about understanding the psychology of adoption.

Meet the Players: The Five Segments at a Glance

Moore broke down the market not by demographics, but by psychographics – how different groups react to disruptive innovation. Understanding these archetypes is step one:

That terrifying gap between the Early Adopters (the visionaries who get it) and the Early Majority (the pragmatists who need proof) isn't just a line on a chart. It's the Chasm – an unforgiving market graveyard littered with the earnest corpses of well-funded startups who mistook initial buzz for sustainable business.

The Innovator Trap: Beware the Shiny-Object Siren Song

Innovators are fantastic. They’re the first ones downloading your beta, filing detailed bug reports, and singing your praises on niche forums. They provide invaluable feedback on the tech itself. But listening too closely to them for market signals is a classic startup blunder.

Why? Because their motivation is novelty, not necessarily utility at scale. They love the idea of the future. Think about the initial hype around Pebble smartwatches, the Segway, or the infamous Juicero. Kickstarter campaigns exploded, tech blogs raved... fueled largely by Innovators and some tech-forward Early Adopters. But that enthusiasm didn't translate into mainstream demand because the value proposition wasn't compelling enough for the pragmatic majority.

The Innovators' curiosity feels like traction, tempting founders to prematurely scale marketing, sales, and operations. Leadership Lesson: Treat innovator love as crucial laboratory data for refining the core tech, but never mistake it for a green light from the market gods signaling broad adoption potential.

Early Adopters: Your First True Allies (If You Find Their Fire)

These aren't just early customers; they're partners in disruption. They're less interested in the tech itself and more in the strategic advantage it might unlock. They have a vision, often driven by intense pain or a unique opportunity the status quo can't address.

Moore’s acid test for finding genuine Early Adopters remains painfully relevant: "Find someone whose hair is on fire." They aren't just interested in a solution; they're desperate for one. They'll tolerate your buggy v1, pay real money, and even co-create solutions because the pain of not changing is greater than the risk of adopting your untested product.

In today's AI wave, the startups winning here aren't selling vague promises of "enhanced synergy" (vitamins). They're delivering tangible, measurable relief for acute business pain (painkillers) – slashing e-commerce return processing time by 40%, automating the soul-crushing parts of legal discovery, generating draft ad copy that actually converts. Growth Insight: Early Adopter revenue validates your problem/solution fit, not yet your scalable market entry.

Life in the Chasm: Where Feature Velocity Meets a Brick Wall

So, you've got Innovator feedback and Early Adopter case studies. Time to scale, right? Wrong. Welcome to the Chasm. This is where the conversations shift dramatically. The Early Majority isn't moved by vision; they're moved by proof and risk reduction.

Suddenly, the things that impressed the Early Adopters – raw potential, bespoke workarounds, your brilliant founding story – are liabilities. The Early Majority wants:

Polished UX: Not duct-taped workflows.

Reliability & Support: Not nightly-deploy YOLO and "email us maybe." They need SLAs.

Peer References: Not "trust me, bro," but "who else like me is using this, and what results are they getting?"

Whole Product: Not just your core tech, but the integrations, training, and support that make it usable in their complex environment.

Most founders stall here because they keep doing what worked before: pitching more features and faster development. But the Early Majority isn't buying features; they're buying safety. They're pragmatists, and adopting unproven tech is a career risk. Feature velocity, without stability and validation, often increases their perceived risk.

The Escape Plan: Enter the Bowling Pin Strategy

Moore’s solution isn't about building faster; it's about focusing smarter. The Bowling Pin Strategy is deceptively simple but requires immense discipline:

Pick One Pin: Identify a single, hyper-specific, narrowly defined market segment (a niche within a niche) where the "hair on fire" problem is rampant, and your solution is uniquely positioned to be the whole solution. This is your beachhead.

Define it Ruthlessly: Know the exact job title, the burning pain point, the budget owner, and the specific channel where you can dominate the conversation for this one group.

Knock It Down Decisively: Focus all your resources – product development, marketing, sales – on winning this single segment. Ship the boring integration work they need. Craft the perfect case study. Turn your initial customers in this niche into raving fans and heroes within their peer group.

Leverage Adjacency: Once that first pin is down (meaning you have dominant market share and strong, referenceable customers), look for the next most similar pin – a segment with a closely related problem that your now-proven solution can address with minor tweaks. Your win in the first niche provides the credibility and references needed to win the second.

Let Momentum Build: Word travels fast within pragmatist communities once a solution is perceived as "de-risked." Success in one niche creates inbound interest from adjacent ones.

Think about Figma: they utterly dominated the product design team niche before expanding horizontally to developer hand-off and broader collaboration. Zoom nailed external client video calls (where reliability was paramount and failure was high-stakes) before it started eating the internal meeting market. They didn't boil the ocean; they knocked down one pin, then the next.

Applying the Framework: Bowling with the 2025 AI Wave

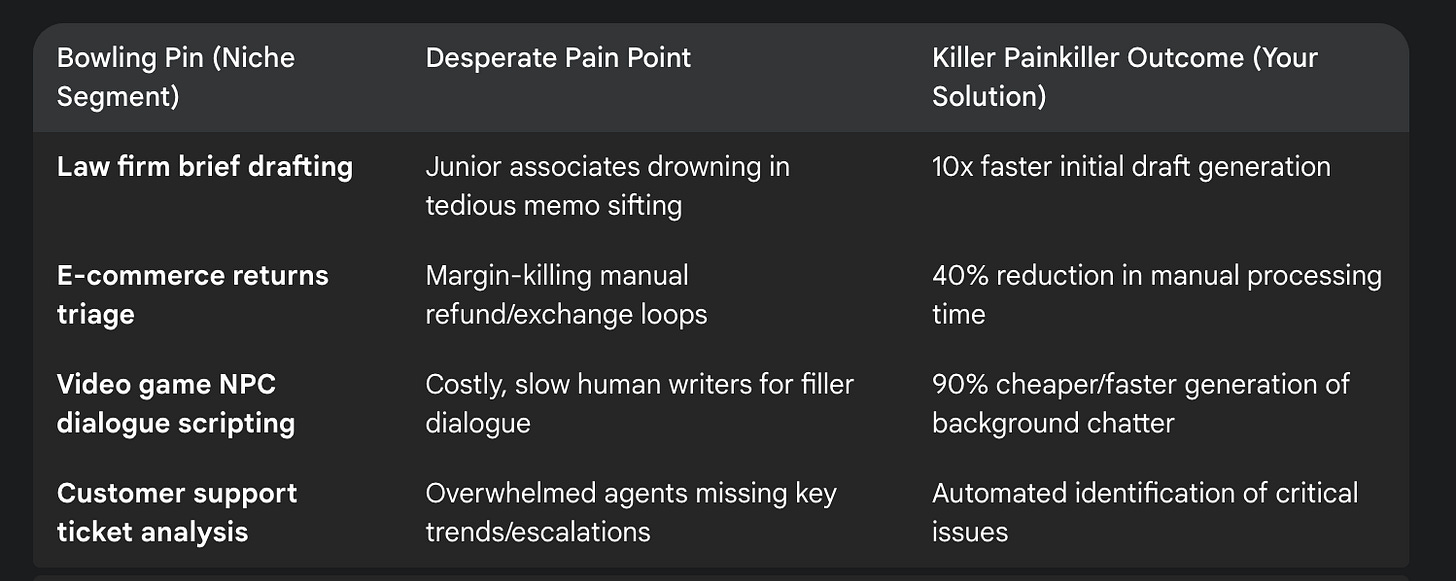

AI is the ultimate horizontal technology – it can do almost anything. That's its power and its peril. The Bowling Pin strategy forces vertical focus. Instead of "AI for business," think:

Actionable Insight: Win one niche decisively. Broadcast the specific ROI and the reference customers. Then, use that momentum to target the next logical pin. AI provides the potential; the bowling pins provide the profitable application.

Founder's Chasm-Crossing Checklist:

Before you claim "product-market fit" and try to leap the Chasm, be brutally honest:

Nail your Beachhead: Can you name your target segment in one sentence without using commas or "and"? If not, it's too broad.

Identify Real Customers: Can you list five specific companies (and contacts) within that beachhead you could realistically call tomorrow? If not, do more research.

Quantify the "Before & After": Can you articulate the value proposition in a single, compelling metric (hours saved, revenue gained, risk reduced, errors eliminated)?

Collect Reference Jewels: Are you treating your successful beachhead customers like gold? Are you capturing their stories and ROI in formats pragmatists trust (case studies, testimonials, joint webinars)? Pragmatists trade these like baseball cards.

Resist "Going Broad": Acknowledge but politely ignore the siren song of adjacent markets until that first pin is unequivocally down and you have the trophy case study to prove it.

Closing Thoughts: Same Physics, New Wave

Every new technology wave whispers the seductive lie: "This time, distribution is different. This time, it will just spread."

It never does.

The underlying human psychology of risk aversion, social proof, and perceived value hasn't fundamentally changed since Moore first sketched his bell curve. The Chasm remains. The pragmatists still need convincing.

So, the next time your investor deck casually mentions "land and expand," pause. Remember the bowling lane. Remember the pins. Remember the Chasm yawning just beyond the initial excitement. Forget cosmic luck. Focus your energy with ruthless precision, knock down that first pin, and you'll find the others start to fall in satisfying succession. It’s not magic; it’s physics.

Great piece Mike